2018 was a huge year for synthetic biology. Numerous companies IPO’d, including one that is looking to power the whole field - Twist Bioscience. The Nobel Prize in Chemistry was awarded for the directed evolution of enzymes. Most importantly, CRISPR technology hit the silver screen, co-starring in a movie with Dwayne “The Rock” Johnson. Thanks to all of this, I no longer simply get blank stares when I tell people that I work in synthetic biology. It is truly an exciting time to be involved in a field that is beginning to shape the world around us.

With all of the attention being paid to the field, it is no wonder that startups were able to raise another record amount of funding this year. Synthetic biology startups had a great year, raising over $2.5 billion of venture funding. This marks the fifth consecutive record year in synthetic biology funding, and the rate at which funds are pouring into startups in the field is only increasing over time. Part of the reason the amount of money in synthetic biology startups is increasing so quickly is that there are startups that are starting to mature and raise huge rounds. This year Zymergen raised $400 million, the largest private round in synthetic biology history, from investors that included the Softbank Vision Fund. This was the first synthetic biology investment for the famous Japanese mega-round investor, but they will likely be back for more in the future.

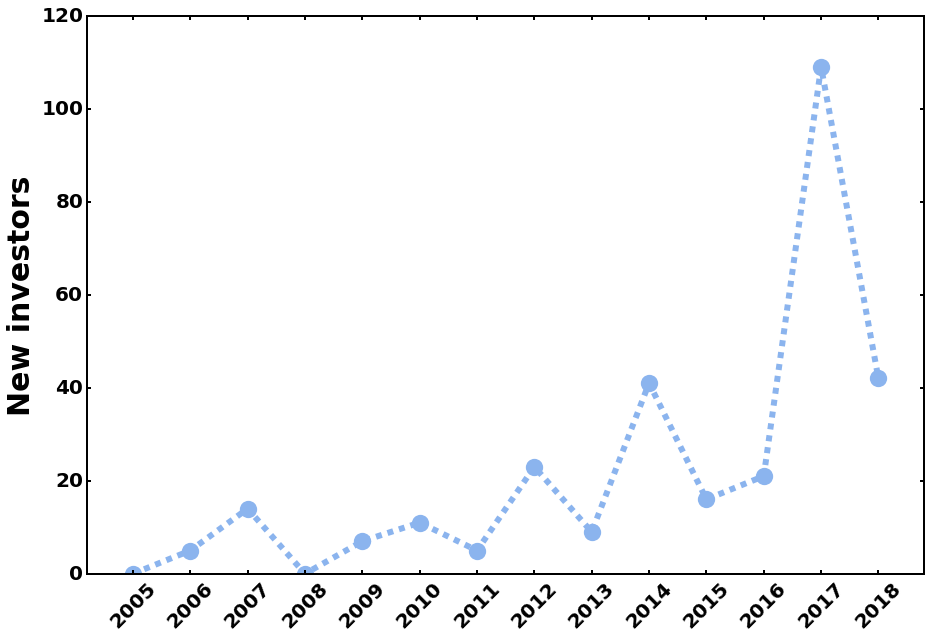

Because companies are beginning to raise larger rounds, a record year for funding did not translate for a record year in terms of the number of rounds raised. This is in line with the broad trends in venture capital - increasing money raised in fewer rounds. 2018 showed a slight decrease in both number of rounds raised as well as companies that were raising their first round of financing. This may be partially due to the fact that new companies that raised their initial, small, seed rounds have not made in onto my radar and into my database. 2017 gained roughly 20 rounds since I put out the yearly venture update last year, and 2018 will likely have the same jump. Either way, the long-term trend for both first rounds and rounds in total is positive, showing the the field is exhibiting good long-term growth.

Even though most of the focus is on big startups raising bug rounds, broadly, synthetic biology startups are still mostly raising early-stage rounds. Around 60% of venture rounds were Seed or Series A. Series B and C rounds made up most of the rest, with very few at D or later. Though early stage still dominates, its fraction is down slightly from a few years ago as startups mature.

Looking at the distribution of applications, investors during 2018 continued to exhibit an increased interest in agricultural companies as they took the top spot. As climate change continues to worsen and threaten the global food supply, synthetic biology offers great potential for making the new, hotter world we inhabit more fertile. The fraction of industrial companies continued to decline even as some began to get products on the market. Synthetic biology supporting companies in reagents, software, and equipment still make up a small but important fraction of the deals closed.

The number of investors who made their first investment in synthetic biology declined from their 2017 peak, but still notched the second-highest amount ever. There are still many firms that are inexperienced in biological technologies, looking to gain experience in this field that need to find the technical expertise to help them make smart choices.

Though the number of first investors declined, there is an increasing number of investors that are making significant commitments to the space. SOSV and Y Combinator both are making a large number of seed investments, getting companies started that Viking Global Investments and Data Collective can follow up on. It is great to have firms focusing in the space, as the experience they gain will make them better advisers to new companies.

Venture Firm: Number of SynBio investments in 2018

Alexandria Venture Investments: 5

Pontifax Agtech: 5

SOSV: 5

Viking Global Investments: 5

Y Combinator: 5

8VC: 4

Data Collective: 4

F-Prime Capital Partners: 4

S2G Ventures: 4

This year, for the fifth year in a row, most of the rounds were raised by companies in Northern California, especially the San Francisco Bay Area. This isn’t necessarily surprising, as most venture capitalists work in this area. There is also a lot of biotech talent in the area, but it is lacking in agricultural and industrial chemicals knowledge. Investors would do well to search out companies from areas outside the coasts who might have some insight into the industries they are trying to change. Outside of the US, most of the companies that raised money in 2018 were in the United Kingdom. This country has put a lot of effort into developing its synthetic biology industry, and it’s clearly starting to pay off.

Overall, synthetic biology had another great year in 2018. The power to shape and direct biology has captured the public’s imagination. As companies begin to put out products of bioengineering, hopefully we can live up to the promises the field has made. That will require researchers and entrepreneurs and investors that use their imagination and experience to create companies that use synthetic biology to create value for a diverse group of people.